RFM Analysis in Ecommerce : Challenging the Big Spender Paradigm

Category :Data Analytics

Published on: 15-03-2024

Diving into the realm of ecommerce, it is crucial to look beyond just the big transactions. RFM Analysis emerges as a game-changer, offering a fresh perspective on customer value. By focusing on Recency, Frequency, and Monetary value. A customer's value doesn't solely reside in the size of a single transaction, especially if their engagement with your brand doesn't persist over time. What about the customers who consistently choose your products or services, whose loyalty and repeated purchases contribute steadily to your revenue? The answer lies in a more nuanced approach to tracking and rewarding customer behaviour.

RFM analysis stands as a straightforward yet potent method, categorizing customers by assigning scores across three key dimensions.

1.Recency: How recently a customer purchased?

2.Frequency: How often a customer purchased?

3.Monetory: How much they spend?

A higher score in these areas signifies a customer's greater value to the enterprise. Leveraging RFM analysis allows for the strategic grouping of your customer base, enabling personalized marketing tactics.

Steps to Perform RFM Analysis

Step 1-Prerequisite : To perform RFM analysis, you need to have data on your customers' purchase history, such as the purchase date, amount spend , and frequency of their transactions.

Step 2-RFM Score calculation: The basic steps involve dividing customers into equal groups based on each metric and assigning them a score from 1(worst) to 4(best)

- Recency Score : Find out how recently each consumer has made a purchase. The recency value can be calculated by the difference in days between the most recent purchase date in your dataset and the last purchase date for each customer . Now assign score to each customer based on the recency value , Higher the score more recent is the purchase.

- Frequency Score: Frequency value is the count of the total number of purchases each client has made during the analysis period to ascertain how frequently they make purchases and assign the scores, higher the score more frequent the purchase.

- Monetary Score: Monetary value is to find how much each customer has spent in total on purchases throughout the analysis period .Based on this monetary value, give each consumer a score, higher ratings correspond to greater expenditure.

So assigning scores to each particular metrics can be done using Quartile method.

How are these Quartiles determined?

Quartiles divide the dataset into four equal parts after sorting the data in ascending order:

Q1 (25th percentile): 25% of the data falls below this value. It's the "middle" value between the smallest number and the median of the dataset.

Q2 (50th percentile or median): 50% of the data falls below this value. It divides the dataset into two equal halves.

Q3 (75th percentile): 75% of the data falls below this value. It's the "middle" value between the median and the highest value of the dataset.

Step 3-Combine all scores: After all the RFM Metrics are scored, now combine all the scores to get the overall RFM score this can be done with 'CONCATENATE' function in DAX. "A customer with a high RFM score would be one who made a purchase yesterday, made a weekly purchase, and spent a lot of money; in contrast, a client with a low RFM score would have made a purchase a year ago, made a single purchase, and spent very little money."

Step 4-Segmentation of customers: According to the RFM score customer have higher RFM score(444) are “best customers” and customers with lower RFM score(111) are the "customers at risk"

Step 5-RFM Categories: RFM Scores are defined differently for each business. Here are some example

| S.No | Customer Segment | Activity |

|---|---|---|

| 1 | Loyal Customers | Spend good money with us. Responsive to promotions |

| 2 | Potential Loyalists | Recent customers but spend good amount and bought more than once |

| 3 | Recent Customers | Bought most recently but not often |

| 4 | About to sleep | Below average recency,frequency and monetory values |

| 5 | At Risk | Spent big money, more frequent long time ago, need to bring them back |

| 6 | Lost Customers | Lowest frequency, recency and monetary scores |

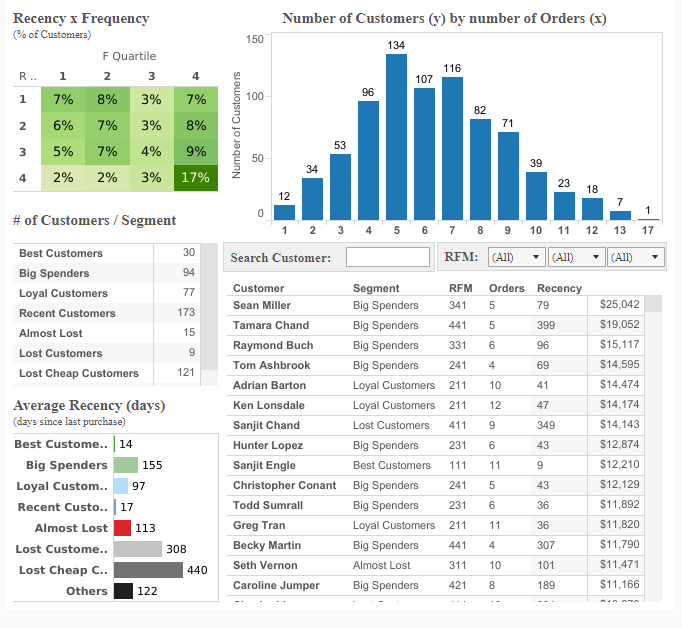

Sample RFM Analysis Dashboard

Benefits of implementing RFM Analysis in our business

Harnessing RFM analysis will unlock a spectrum of advantages for business, propelling towards a more data-driven, customer-centric approach. Here's how:

- Increases customer lifetime value

- Increases customer retention

- Improves marketing ROI

- Identifies most valuable customers

- Identifies which customers are at-risk

- Improves campaign effectiveness

Conclusion

At IN22LABS, our real-time monitoring dashboards, enhanced with RFM Analysis, have revolutionized our clients' e-commerce engagement strategies. By adopting this data-driven approach, our clients have achieved deeper customer engagement and developed personalized marketing campaigns, leading to significant improvements in retention and growth. Our commitment to delivering cutting-edge analytics solutions like RFM Analysis underscores our role as a catalyst for innovation and success in the e-commerce sector, always with a keen focus on customer satisfaction.

Tags

- 0

- 0

You May Also Like

08-03-2024

04-03-2024

12-02-2024

Big Data Processing with Apache Spark — the last journey through a fragmented data world

Data Analytics

12-01-2024

05-01-2024

10-02-2024

24-01-2024